The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking About

Wiki Article

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

Table of ContentsThe 6-Second Trick For Mileagewise - Reconstructing Mileage LogsThe Ultimate Guide To Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Can Be Fun For AnyoneA Biased View of Mileagewise - Reconstructing Mileage Logs3 Easy Facts About Mileagewise - Reconstructing Mileage Logs ExplainedThe 45-Second Trick For Mileagewise - Reconstructing Mileage LogsIndicators on Mileagewise - Reconstructing Mileage Logs You Should Know

Timeero's Fastest Distance attribute recommends the fastest driving path to your workers' destination. This attribute boosts performance and contributes to cost savings, making it an essential possession for services with a mobile workforce.Such a method to reporting and compliance simplifies the typically complex job of handling mileage costs. There are numerous benefits linked with using Timeero to monitor gas mileage. Let's have a look at several of the application's most noteworthy features. With a trusted mileage monitoring device, like Timeero there is no demand to fret regarding unintentionally leaving out a day or piece of information on timesheets when tax time comes.

Some Of Mileagewise - Reconstructing Mileage Logs

With these devices in operation, there will certainly be no under-the-radar detours to increase your reimbursement costs. Timestamps can be discovered on each mileage entrance, boosting reputation. These extra confirmation procedures will certainly maintain the IRS from having a reason to object your mileage documents. With precise mileage tracking innovation, your staff members don't need to make harsh mileage price quotes and even stress about mileage expenditure monitoring.

If an employee drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all car costs (simple mileage log). You will certainly require to continue tracking gas mileage for job even if you're making use of the actual expenditure technique. Maintaining gas mileage records is the only way to separate service and individual miles and give the evidence to the IRS

A lot of mileage trackers allow you log your trips by hand while determining the range and repayment quantities for you. Many additionally come with real-time journey tracking - you require to begin the app at the beginning of your journey and stop it when you reach your final location. These apps log your start and end addresses, and time stamps, together with the total range and compensation quantity.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

One of the questions that The INTERNAL REVENUE SERVICE states that vehicle expenses can be taken into consideration as an "ordinary and required" cost throughout doing business. This includes costs such as gas, maintenance, insurance policy, and the automobile's devaluation. For these expenses to be taken into consideration deductible, the visit their website lorry needs to be used for service functions.

Top Guidelines Of Mileagewise - Reconstructing Mileage Logs

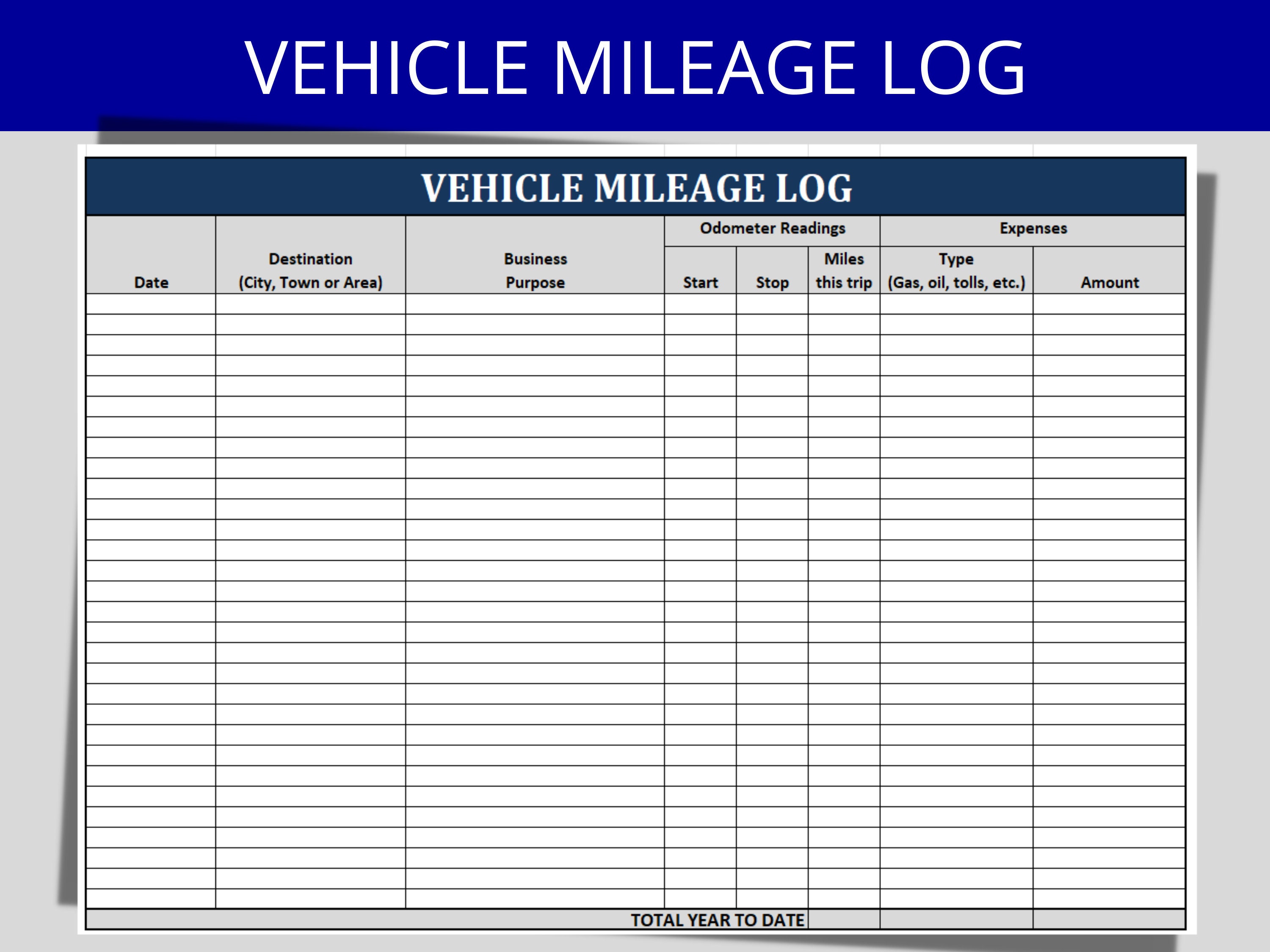

In in between, carefully track all your business trips keeping in mind down the beginning and finishing readings. For each trip, document the place and business function.This consists of the complete organization mileage and complete gas mileage build-up for the year (service + personal), journey's date, location, and function. It's essential to videotape tasks quickly and preserve a contemporaneous driving log describing day, miles driven, and company purpose. Here's exactly how you can improve record-keeping for audit purposes: Beginning with guaranteeing a careful gas mileage log for all business-related travel.

10 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

The real costs technique is an alternate to the typical mileage rate technique. As opposed to determining your reduction based on a fixed rate per mile, the actual costs method allows you to subtract the real prices connected with utilizing your car for organization objectives - mileage tracker app. These prices consist of gas, maintenance, repair work, insurance policy, devaluation, and other related expendituresThose with significant vehicle-related costs or unique problems might benefit from the actual costs approach. Eventually, your picked approach must straighten with your details financial goals and tax obligation scenario.

Fascination About Mileagewise - Reconstructing Mileage Logs

(https://mi1eagewise.start.page)Determine your complete business miles by utilizing your start and end odometer readings, and your tape-recorded business miles. Properly tracking your specific gas mileage for organization trips aids in substantiating your tax reduction, especially if you decide for the Requirement Mileage method.

Keeping an eye on your mileage manually can call for diligence, however keep in mind, it can save you cash on your taxes. Comply with these actions: List the day of each drive. Tape-record the complete gas mileage driven. Think about noting your odometer readings before and after each journey. Write the starting and ending points for your journey.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

And now virtually every person makes use of General practitioners to obtain about. That suggests almost everybody can be tracked as they go concerning their organization.Report this wiki page